In an article published by La Presse, Jean-Sébastien Gilbert, a mortgage broker with Multi-Prêts Mortgages, explains how refinancing can help homeowners regain control of their finances.

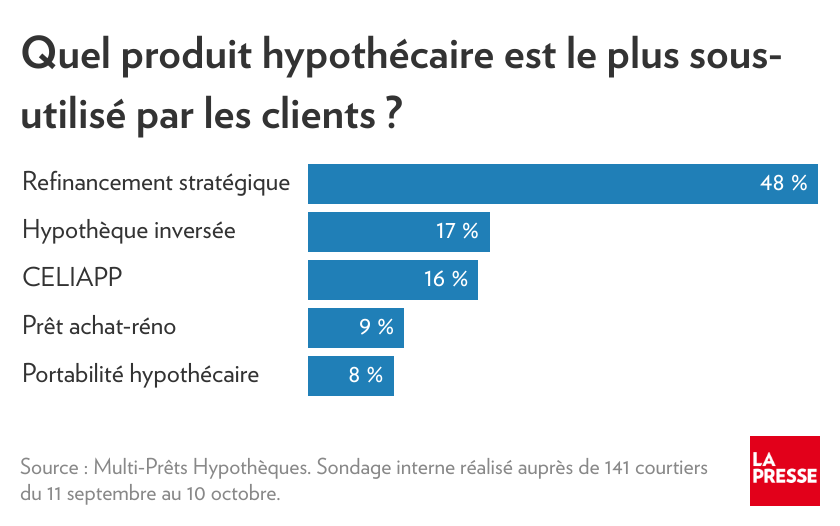

According to an internal survey conducted among Multi-Prêts brokers, mortgage refinancing remains the most underused strategy among clients, often due to a lack of awareness of the options available.

Jean-Sébastien Gilbert notes that about one-third of clients now choose refinancing, roughly 10% more than before the pandemic. “Often, people don’t seek advice. They’re caught up in their day-to-day lives. They accept their monthly payments as an obligation and don’t realize there’s probably a way to restructure everything. That’s exactly what we do,” he explains.

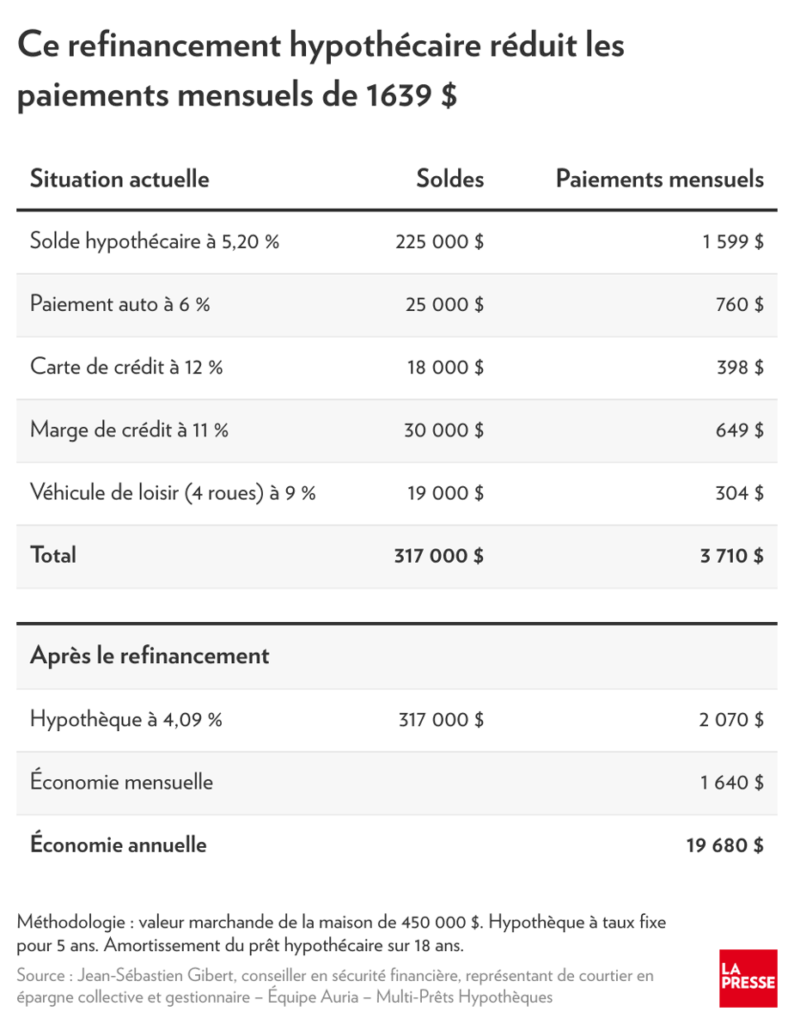

For example, a couple who still owes $225,000 on a property purchased in 2022 at an interest rate of 5.2% could reduce their monthly payments by approximately $1,600 through mortgage refinancing, while also paying off their debts.

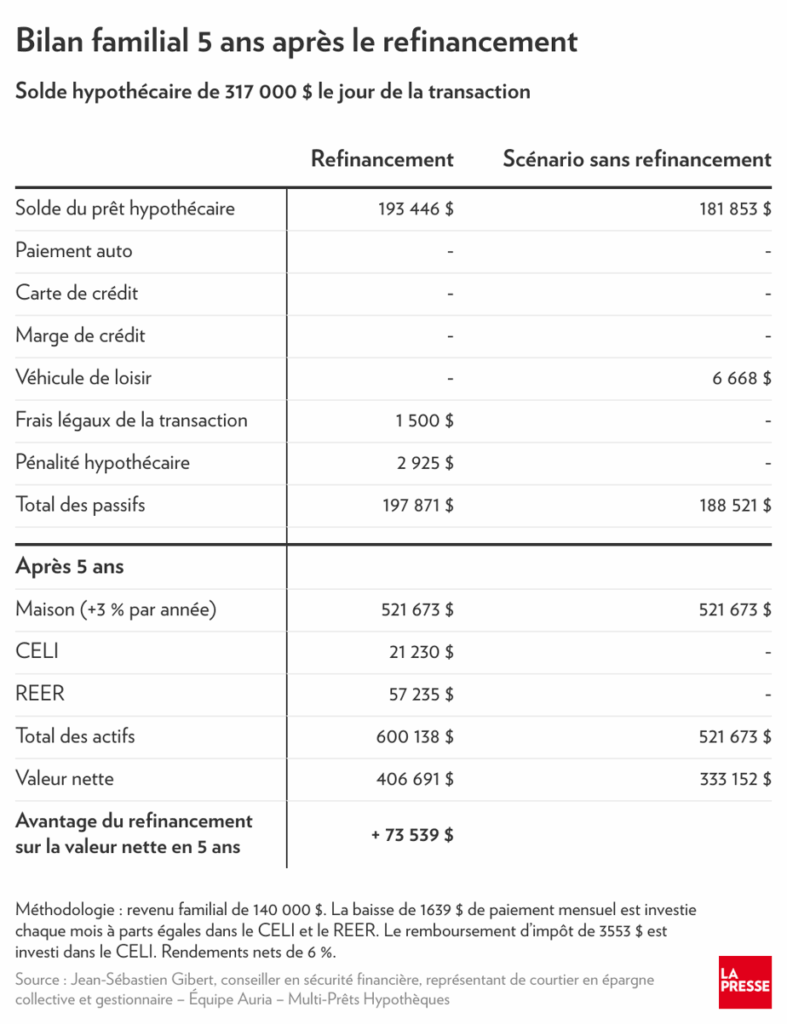

For Jean-Sébastien Gilbert, refinancing often makes it possible to “stop the budget bleeding” and start fresh on a healthier financial footing, provided discipline is maintained: “For it to work, it takes rigor, consistency, and it isn’t easy.” This discipline can pay off, after five years, households that reinvest their monthly savings often see a significant improvement in their financial situation.

Mortgage refinancing is not just a last-resort solution, it is a financial planning tool. A Multi-Prêts mortgage broker can help you assess your situation and determine whether this strategy is beneficial for you.