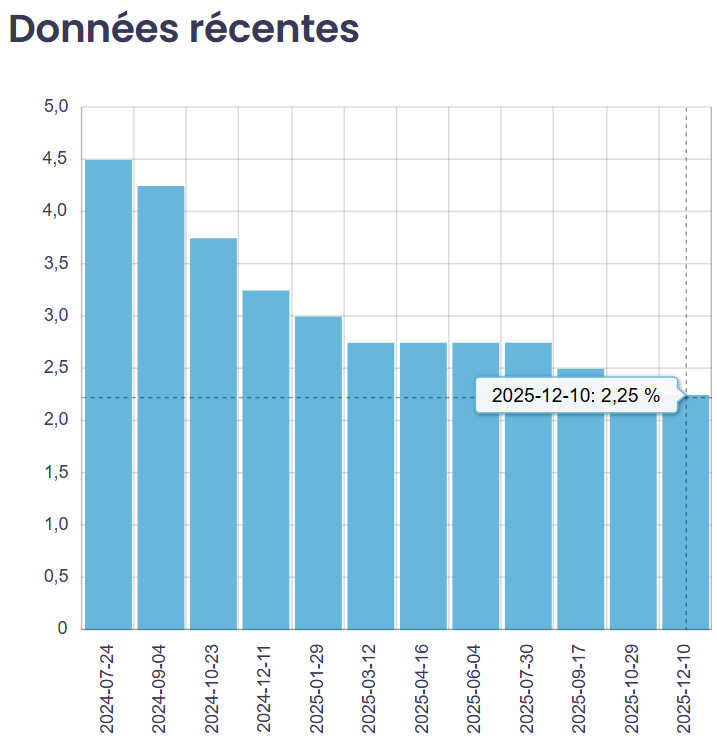

This morning, December 10, 2025, the Bank of Canada announced that it is maintaining its key interest rate at 2.25%.

The Governing Council believes the current level of the rate remains appropriate to keep inflation near the 2% target while supporting the Canadian economy amid heightened uncertainty and uneven growth across sectors.

Globally, major economies continue to show resilience despite a more complex trade environment, notably due to U.S. protectionist policies. In Canada, growth exceeded expectations in the third quarter, but the Bank anticipates a temporary slowdown in the near term, followed by a gradual recovery in 2026.

The labour market is showing some signs of improvement, although hiring intentions remain moderate, while overall inflation continues to hover near the target, with short-term fluctuations expected.

The next key interest rate announcement is scheduled for January 28, 2026. We will continue to closely monitor economic developments and their impact on the mortgage market.

Implications

The Bank of Canada’s target for the overnight rate influences the prime rate set by major financial institutions, to which the interest rates on variable-rate mortgages are tied. Today’s announcement is therefore not expected to change the posted rates on variable-rate mortgage loans.

However, the Bank of Canada’s key interest rate does not determine rates on fixed-rate mortgages.

Pourquoi faire appel à un courtier hypothécaire ?

In an environment where Bank of Canada decisions are increasingly difficult to predict, having an expert on your side is more important than ever. A mortgage broker can help you understand the impact of key interest rate movements on your financing strategy and guide you toward an option suited to your situation, whether for a purchase, renewal, or refinancing.